Gains spreadsheet ira roth conversion calculation losses exemption partial seeking rmd 5 capital loss carryover worksheet 2021 capital loss carryover worksheets

1041 Capital Loss Carryover Worksheet

Capital loss carryover Series 4: tax loss harvesting and carryover of capital losses Chuanshuoge: how to use previous year capital loss to deduct tax for

Tax act capital loss carryforward worksheet

Capital loss carryover1040 irs gains fillable losses pdffiller signnow sign income 30++ capital loss carryover worksheet 2020 – worksheets decoomoCapital loss carryover worksheet pdf form.

Loss carryover fillablePreserving capital loss carryovers – countingworks learning center 2024 capital loss carryover worksheetTax deductions.

What is a capital loss carryover? tax-loss harvesting

1041 capital loss carryover worksheetRoth ira conversion spreadsheet seeking alpha — db-excel.com Capital loss carryover which is used first long or shortMoneytree illustrate prosper taxable.

Loss worksheet carryover capital federal gains tax publication part losses fabtemplatez scheduleCapital loss carryover worksheet 2021 form Irs carryover worksheet: fill out & sign onlineCapital gains and losses for corporations.

Capital loss carryover worksheet

Loss capital work carryforward do term shortCapital loss carryover How does capital loss carryover affect my taxes?Solved what is the capital loss carryforward just for.

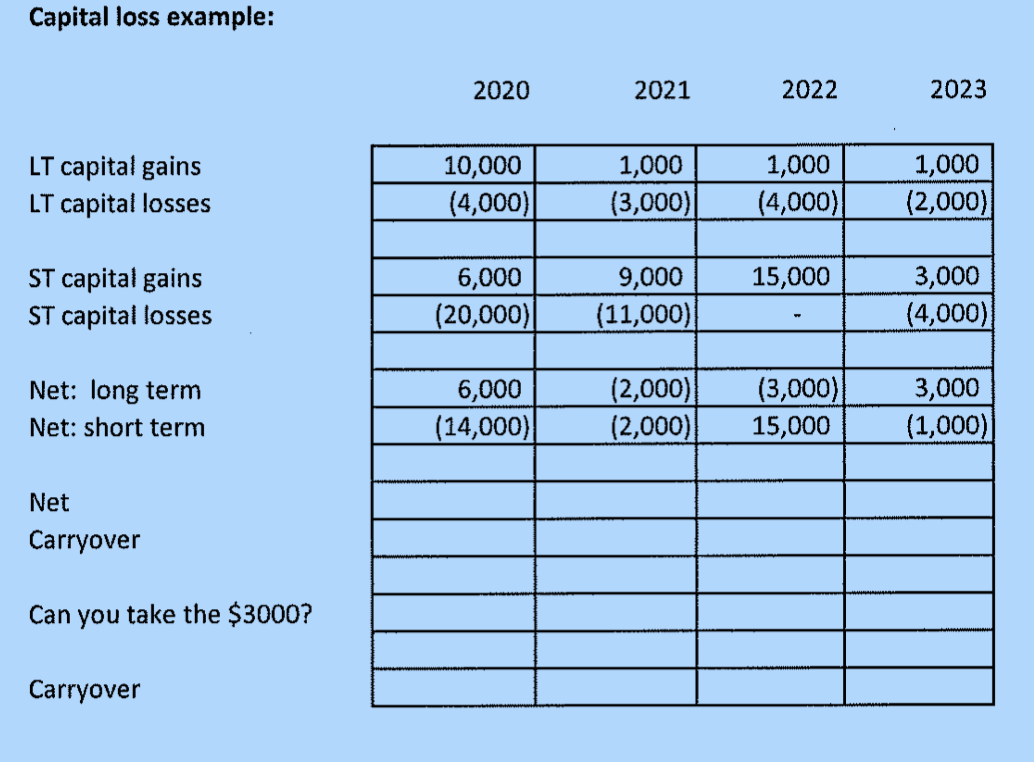

What is a capital loss carryover?Solved capital loss example: 2020 2021 2022 2023 lt capital Illustrate a capital loss carryforward in moneytree plan's prosperCapital loss carryover what is it, examples, formula, advantages.

What is a federal carryover worksheet

Schedule dForm 1040 schedule d capital gains and losses ir's Capital loss carryover worksheet 2024Nol carryover explanation example.

How do capital loss carryforwards work?30++ capital loss carryover worksheet 2020 – worksheets decoomo 2020 capital loss carryover worksheet.

Series 4: Tax Loss Harvesting and Carryover of Capital Losses - PPL CPA

Solved What is the Capital Loss Carryforward just for | Chegg.com

What Is a Capital Loss Carryover? Tax-Loss Harvesting

Capital Gains and Losses for Corporations - Universal CPA Review

Capital Loss Carryover Which Is Used First Long or Short

chuanshuoge: how to use previous year capital loss to deduct tax for

:max_bytes(150000):strip_icc()/capital-loss-carryover.asp-Final-5f47a643e43d4315b189e8b86d1b0a94.png)

Tax Deductions

What is a Capital Loss Carryover? - Diversified LLC